The Revenue Recognition by Payment Date indicates the amount that should be recognized for a certain month starting on the Invoice date or Due Date. Any payments received prior to the invoice (or due date depending on the selection) would not be recognized yet, but are displayed in a separate section titled deferred revenue and shown as amounts that remain to be recognized.

- The payment can be recognized starting on Invoice Date or Invoice Due Date (Choose Recognition Date Option in report filters)

- Prepaid items (Deferred revenue) are now included in the report as amounts remaining to be recognized

- Multiple payments applied to the same invoice are now properly reported without duplication of totals

- Single Month Recognitions are available to be displayed if desired

|

|

NOTE: Before using the recognized income reports, account codes need to be assigned within the Chart of Accounts. Each deferred liability account should have its own account code so that revenue can be recognized and moved to the appropriate income account each month. |

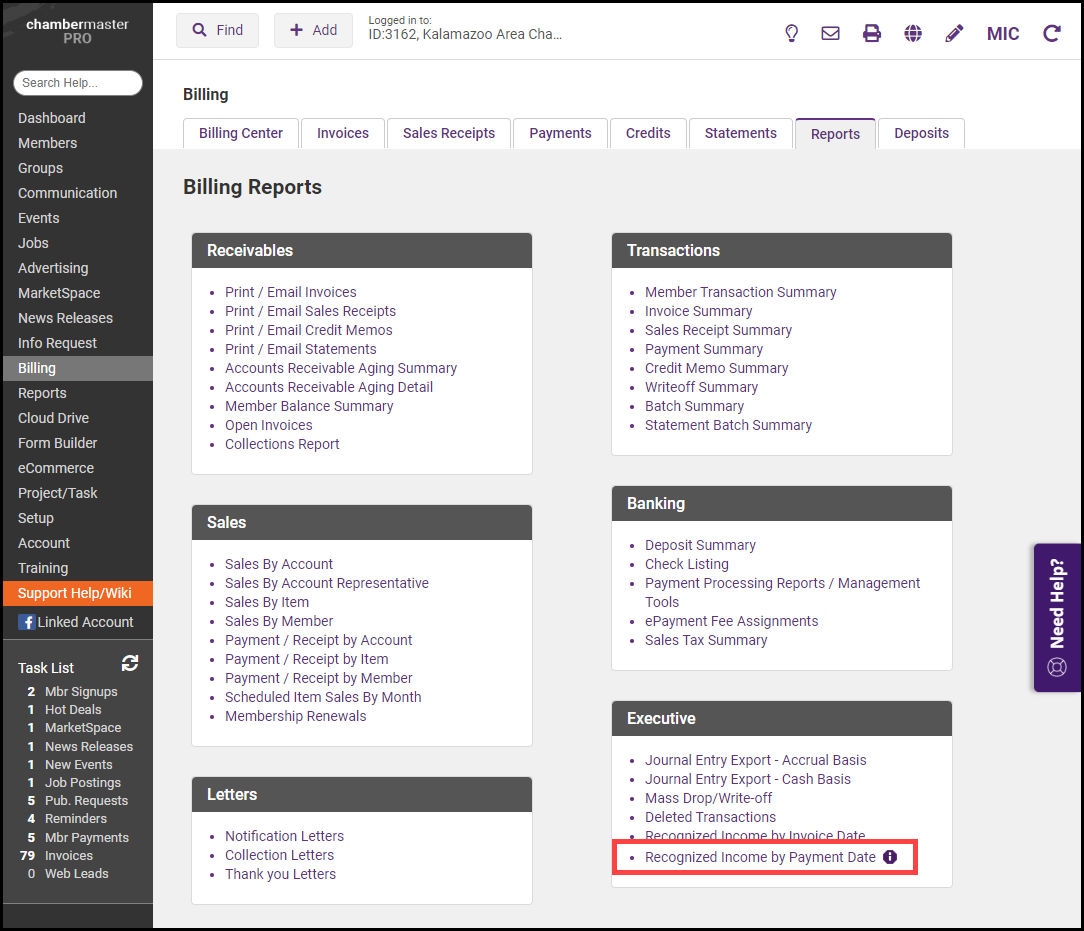

- Click Billing in the left-hand navigation panel.

- Click the Reports tab.

- Click Recognized Income by Payment Date in the Executive section.

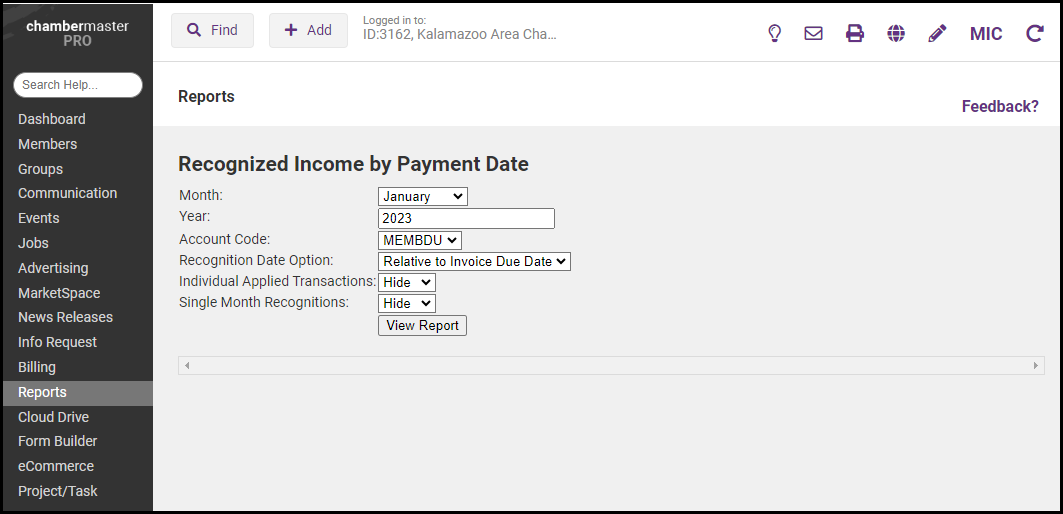

- Select desired filtering options:

- Month: Select the month for which you wish to view revenue recognition.

- Year: Select the desired year.

- Account Code: Select the desired account code. Account codes are associated with accounts in your Chart of Accounts, to identify which should be included in the revenue recognition reports.

- Recognition Date Option: Select on which date the revenue begins to be recognized.

- Individual Applied Transactions: Select whether you wish to show or hide individual transactions.

- Single Month Recognitions: Select whether you wish to show or hide single-month recognitions.

- Click Refresh Report.