General

Can I use GrowthZone Pay if I have the legacy QuickBooks CQI integration?

No, not at this time.

What country can I be from (my legal entity) to set this up?

United States, Canada, Ireland, the United Kingdom, and Australia.

If using the ACH and bank account storage feature, what countries are supported for where the bank account can be located?

United States banks only.

What currency types are supported for the amounts that will be charged to their cards?

US dollar, Canadian dollar, Euro, English pound, and Australian dollar. You will select your default currency type that will be used on all transactions on the Account Setup screen.

What international support is available for bank locations and supported currencies?

International customers may choose their desired currency: US dollar, Canadian dollar, Euro, British pound, or Australian dollar (only one supported per database). Your bank account where automatic deposits/transfers are made may be located in the US, Canada, Ireland, the United Kingdom, or Australia. The same transaction rates and fees apply as above, with no additional charges.

What payment card types are accepted?

Both debit and credit cards are accepted. U.S. businesses can accept Visa, MasterCard, American Express, JCB, Discover, and Diners Club. Canadian, Australian, and European customers can accept Visa, MasterCard, and American Express. You can also accept gift and prepaid cards that are one of the above types.

Setup Questions

What are the steps involved to enable GrowthZone Pay after my database is enabled?

Three easy steps are required to start accepting payments. Watch this video for a 3-minute demonstration.

- Log in to your database and complete the Account Setup screen.

- Modify any credit card settings if needed.

- Run a quick test.

How long does it take to get set up? Can I process credit card transactions immediately?

Yes. You can receive charges into your bank account immediately for up to ~$2,000 after simply submitting the form with the minimum required fields completed. However, if Stripe needs more information to complete the verification process, transfers of money beyond ~$2K into your bank account will be suspended until after your account has been fully verified.

Will I be notified when my account is verified?

An email will come to the email address entered when you fill out your Account Setup information. If no email address was entered there, then the email address listed under Billing ➝ Reports ➝ Payment Processing Reports ➝ Other Reports, Features, and Settings will be used, or lastly, the email address under Setup ➝ Association Information. You can also check your status under Setup ➝ Billing Options and Settings in the Credit Card section. Details Verified will change to "True" once you've been verified.

Where do I enter my verification information?

Under Setup ➝ Billing Options and Settings in the Credit Card section. Click Account Setup.

Are there any businesses, business activities, or business practices that I may not accept payment from?

Yes. As part of your agreement with Stripe and GrowthZone, you agreed to never accept payments in connection with the businesses, business activities, or business practices listed here.

What types of cardholder verification are supported?

CVV and address verification.

Can I have more than one bank account where the transfers are deposited?

Although you can have more than one bank account listed in the Account Setup, only one of those can be active at a time. Indicate which bank account is active by selecting the default account for your currency type when editing the bank account information under Setup ➝ Billing Options and Settings in the Credit Card section.

Does this solution replace both my merchant account and gateway?

Our solution replaces the need for any other merchant account or gateway for receiving payments into your database by doing all the tasks necessary for a complete transaction - accepting the payment data and depositing the funds into your bank account. All transactions that are performed in the database are handled by our single solution.

Why do I need to agree to Stripe's terms of agreement when signing up?

GrowthZone has implemented GrowthZone Pay using an API provided by Stripe. As part of our agreement with Stripe in using their API, our customers (you) need to agree to both our terms of agreement for GrowthZone Pay and Stripe's agreement. In the agreement, you are considered the Connected Account, and GrowthZone is the Connect Platform.

Who is Stripe?

Stripe started in 2009 and is now considered an elite startup company after striking a deal with Apple and Twitter in Sept 2014.* Stripe stands out from rivals for the amount and ease of code it offers, which lets software programmers quickly incorporate payment features into their apps. They are based in San Francisco with worldwide offices. It is currently implemented in checkout carts of Twitter, Kickstarter, Shopify, Salesforce, Lyft, and others.

Is Stripe PCI compliant?

Yes. See their information listed here.

What type of security do you have in place?

Security is of supreme importance in our implementation and in who we partner with, which is one of the reasons we partnered with Stripe, Inc. GrowthZone does not store, process, and/or transmit cardholder data. GrowthZone has implemented GrowthZone Pay using an API provided by Stripe which provides a method for securely sending sensitive information to Stripe directly from the customer’s browser. Collection, storage, and processing of all cardholder data are all handled by Stripe, Inc. Security measures provided by both GrowthZone and by Stripe meet and maintain the high standards required by PCI-DSS security compliance. GrowthZone conducts and passes monthly PCI compliance scans to ensure we remain in compliance with areas that apply to us. Stripe has been audited by a PCI-certified auditor and is certified to PCI Service Provider Level 1, the most stringent level of certification available. Stripe is also a participant in the PCI Security Standards Council. See Stripe’s website for their answer to their security compliance.

Do I need to create my cybersecurity policy?

Your organization’s risk and responsibility in regards to the implementation within GrowthZone’s software is minimal due to the security methods in place by both GrowthZone and Stripe; however, the source of security breaches is varied, and if it came down to an investigation, it might be part of your responsibility as well. So we never discourage an organization from creating and maintaining its own information and cybersecurity policy for managing risk or obtaining its cybersecurity liability policy. With vulnerabilities and threats constantly evolving and the future unknown, of course, being prepared is always the best practice. Legally speaking, however, nothing is required on your end. Read more on cybersecurity policies here and view Stripe’s legal conditions here.

What if I want to switch to GrowthZone Pay, but I have an automatic billing setup with a third-party processor and have manual epayments assigned to my members, which automatically create my transactions for me each month when I run my monthly epayment batch?

There are two ways to approach the transition to GrowthZone Pay for automatic recurring billing that is currently done outside of the database with a 3rd party processor.

- Gradual: Continue using your 3rd party processor for the recurring billing. Whenever a member successfully enters their account info as a new payment profile in the Member Information Center (MIC), change their fee assignment from Manual epayment to the Automatic epayment associated with their newly entered profile. When running your monthly epayments batch, it will include both the manual epayments and automatic epayments in the same batch. Remember to disable the automatic billing in your 3rd party processor whenever you assign the member to the new automatic epayments.

- Immediately: After the last 3rd party batch has been processed, stop using it for recurring billing and do not use it for your next batch. Next, remove the manual epayment assignment from your member fees. (This means they would temporarily be included in the regular Monthly Renewals batch and would receive an invoice.) Once the member has successfully entered their account info as a new payment profile in the Member Information Center (MIC), you can enable the automatic epayment of the member fee. When at least one member is set up with an automatic epayment assignment, then you will need to begin running the monthly epayment batch.

My members have a credit card and bank accounts stored with my third-party processor, and I use their recurring billing with no transaction automatically created in the database (not using Manual epayments). Can I have these accounts transferred to GrowthZone Pay, or will my members have to re-enter them?

They need to be re-entered. Due to PCI compliance rules and other security concerns, these profiles may not be transferred from one processor to another – they must be re-entered.

If I switch to GrowthZone Pay, does GrowthZone contact my previous processor?

No. Your account with your previous processor is your responsibility to close out or maintain. However, you want to handle it.

Is there a minimum purchase that can be made?

Yes - 50 cents.

What is the maximum size for my Statement Descriptor?

Yes, 22 characters. This is the phrase that will appear on your customer's credit/debit/bank statements.

Will I know which staff person processed the single, direct transactions that do not create a billing transaction?

Yes. Entries are recorded in the Setup ➝ System Event Log when any transaction is made to GrowthZone Pay. The single, direct transactions specifically mention the name of the staff person who ran the transaction.

Will I receive any emails when purchases are made?

Yes. An email from the database will come to the email address listed under Setup ➝ Billing Options and Settings in the Credit Card section.

The person who signed up for this account is no longer with the organization. How do I make sure to update this account with an updated contact name?

Contact GrowthZone support via email with the name of the contact that you’d like to have listed as the contact. An email verification will be sent back to you stating that this change has been made.

How do I issue a refund?

Click the Refund link on the Payment Processing Report or a fully applied payment. Then follow the steps for creating the appropriate bookkeeping entry.

How soon will my customer see the refund in their account?

The customer will receive the funds from a refund in their account approximately 5–10 business days after the date on which the refund was initiated.

How soon is money deposited (transferred) into my account?

Your very first deposit may take up to 7 days to be deposited. After that, deposits (transfers) are made daily and are typically composed of the payments that were processed two days prior for most US and Australian customers, and seven days for other countries. Also, keep in mind that transfers that are scheduled on weekends or holidays won’t be accepted by your bank until the next business day. Also, some US and Australian customers may initially be set for a seven-day transfer while business activity is evaluated. On occasion, banks may take 2-3 additional days to post funds.

Standard payout timing: 2 business days (applies to Australia and the United States (except businesses in higher-risk industries))

Payouts of your available account balance are made daily and contain payments processed two business days prior (this is how long it takes for your pending account balance to become available on this schedule). For example, payments received on a Tuesday are paid out by Thursday, and payments received on a Friday are paid out by Tuesday. If your business operates in a higher-risk industry, this schedule may not be immediately available. We require a short period to monitor your business activity before it can be enabled, in which case a 7 calendar schedule would apply instead. This delay protects your business, customers, and Stripe from the increased risk of fraudulent activity.

4 business days (applies to New Zealand)

Payouts are made daily and contain payments processed four business days prior. For example, payments received on a Monday are paid out by Friday.

5 business days (applies to Malaysia)

Payouts are made daily and contain payments processed four business days prior. For example, payments received on a Monday are paid out by the following Monday.

7 calendar days (applies to All countries except Japan, and high-risk businesses in Australia or the United States)

Payouts are made daily and contain payments processed seven calendar days prior. For example, payments received on a Tuesday are paid out by the following Tuesday.

30 calendar days (applies to Brazil)

Payouts are made daily and contain payments processed thirty calendar days prior. For example, payments received on July 1st would be paid out on July 31st.

Weekly (applies to Japan)

Payouts are made once a week (on a day of your choosing) and include payments processed between 4-11 days prior. For example, if payouts are scheduled on Wednesdays, your account balance from Sunday of the previous week until Saturday of the previous week is deposited every Wednesday.

Alternative payout schedules

If you would prefer to receive payouts on a fixed schedule, you can choose to have them sent either weekly or monthly in your account’s payout settings.

When selecting a weekly schedule, you can specify the day of the week that payments should arrive in your bank account. For a monthly schedule, you can specify the day of the month. Payouts scheduled between the 29th and 31st of the month are sent on the last day of shorter months. Selecting either a weekly or monthly schedule does not change how long it takes for your pending balance to become available. If your account was previously operating on a two-business-day daily payout schedule, it still takes two business days for your pending balance to become available. For instance, if a Stripe account changes from two business days rolling to weekly on Fridays, the available balance includes payments made in the last week before Wednesday.

Why does the date listed on the Deposit/Transfer report not match the date of the actual deposit into my bank?

The Date identified as the Deposit/Transfer date is the intended/scheduled deposit date indicated by Stripe. The actual deposit date could be delayed most commonly because most banks do not process transfers on weekends.

Do all credit card transactions carry over to the Journal Entry Export report?

No. Payments, Receipts, and Refunds (negative Sales Receipts) that are automatically created by the software will be included in the JEE. However, you will need to make a manual adjustment in your accounting software to record processing fees, dispute fees, or chargebacks, as those will not be deducted from the journal entries. Use your Bank Account Deposits/Transfers report to find the totals of each deposit that will need to be adjusted.

For QuickBooks users using the detail journal entry export option, it is recommended that deposits be handled within QuickBooks. Be sure to select the ‘Exclude Deposits’ option at the time of export. When the deposit is recorded in QuickBooks, a line item can be added to account for the total amount of the fees that were withheld from each transaction, resulting in a net deposit that will match bank statement activity. View detailed steps.

How do you recommend I record my transaction fees so that my deposits match what is actually being deposited?

Include the transaction fee amount, which is shown on the Bank Account Deposits/Transfers report, as part of your deposit in your accounting software. View detailed steps for those using the detail Journal Entry Export with QuickBooks Desktop.

We want our members to pay off their annual dues by paying 3 equal payments in 3 consecutive months. Can we automatically charge a card for consecutive months in a row and then stop charges for the remainder of that year?

Yes, this can be set up to accommodate any number of consecutive equal payments. How? Assign a monthly epayment fee item to this member and set the Status to Active in Date Range. The Start Date should be the 1st month that you want the payment to be charged and the Expiration to the month of the last payment (inclusive). The amount charged per month will be the Fee Amount / 12 so you will need to inflate the Fee Amount assigned so that when it divides by 12 it will be what you want to charge monthly. The example shown here would charge $400 in April, May, and June totaling a $1200 annual fee but requires putting $4800 in the Fee field. Note: the Fee field is not visible to members or in your accounting totals.

Can we set our ePayments to charge on a particular day of the month?

If you have enabled Allow Automatic ACH/Credit/Debit Card Charges under your Billing Options & Settings, you will be able to select a particular date for e-payment charges. If you have NOT enabled this setting, your ePayment charges happen on whatever day you log in to the software and click to process the epayment batch. See Set Up Autopay of Payment Profiles for further information on implementing automatic charges.

Can I charge certain members on the 1st and others on the 15th?

If you have enabled Allow Automatic ACH/Credit/Debit Card Charges under your Billing Options & Settings, you will be able to select a particular date for e-payment charges. If you have NOT enabled this setting, your ePayment charges happen on whatever day you log in to the software and click to process the epayment batch. So, when creating your batches, you can create a batch on the 1st of the month and choose the members that you wish to bill. Then, on the 15th of the month, you can create a batch for those you wish to bill on the 15th. See Set Up Autopay of Payment Profiles for further information on implementing automatic charges.

What if I already have automatic credit card processing with a 3rd party company, but want to set GrowthZone Pay recurring charges?

No problem. Follow the steps for Setup Recurring Charges, but modify the initial message to indicate that you are changing your processor and need your member's help. In addition, follow these steps:

-

If members were assigned a manual epayment fee when set up with your 3rd party company, switch it to the appropriate epayment selection once the member has entered the new epayment profile into the MIC. You can continue to run your epayment batch with a mix of manual and automatic epayment in the batch.

-

If members were not assigned either a manual or ean payment fee when set up with your 3rd party company, no additional steps are needed - just assign the epayment fee once the member enters it into the MIC.

I did a refund today. Does the refund display on my Payment Processing report?

The Payment Processing report is just that - it shows the payments that have been processed or attempted to be processed (failures). It does not itemize refunds in a line of its own. Refunds are visible in the Monthly statement, and then they are detailed in the Bank Account Deposits/Transfers report as a Payment Refund and an Adjustment. When balancing for the month, check the Monthly Statement for refund quantity and total, and then find the adjustment in the Deposits/Transfer report and use the Txn ID (starts with ch_) that is being refunded if you need to locate the original payment.

|

|

NOTE: If you go back to the original payment on the Payment Processing Report, it will display (Refunded: $amount), and the Refund link will no longer be available if fully refunded. |

Member Use

My member stored a bank account as one of their payment profiles in the Member Information Center, but it says "Unverified" next to it. What does that mean?

The member’s bank account needs to be verified as a valid bank account. To do that, the member needs to check their bank account for two small deposits that will have been made. Then they enter those amounts into their payment profile where indicated. The deposit items, labeled "MemberZone TRANSFER VERIFICATION", will typically show on the next business day after the account was created.

My member has entered a payment profile for their bank account in the Member Information Center. Why doesn't it show as an option under "Charge to ACH, debit or credit card" when I go to assign and set up their recurring charges?

The bank account will not show in the "Charge to ACH, debit, or credit card" selection dropdown list until the account has been verified.

Why was a member’s charge declined?

Review the Automated ePayment Transactions report for information on why a member's payment has been declined.

How do I find out more information about a specific decline?

If all of the card information seems correct, it is best to have your customer contact his or her bank, inquire for more information, and ask for future charges to be accepted.

How do I decrease the likelihood of declines?

The correctness of the card number, the expiration date, and the CVC are the primary factors used by the customer’s bank when deciding whether or not to accept a transaction. Collecting the CVC can significantly decrease your decline rates. If you’re not collecting CVCs and you’re having issues with declines, requiring the value can be a quick fix. The influence of other data that you collect, like the address or name, varies by card brand. For example, only American Express considers the customer’s name. If you are still seeing troubles with declines after collecting the more influential fields, it might be worthwhile to collect this additional data.

Disputed Charges

What happens if a charge is disputed?

An email notification is sent to the address listed in the Payment Processing Reports / Management Tools that indicates the details of the dispute and gives directions on how to resolve the dispute.

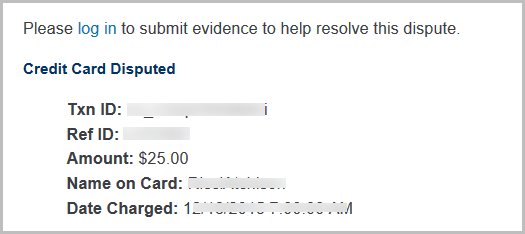

What information does a sample dispute email notification include?

Where do I enter dispute information?

-

Access the Payment Processing Report under Billing ➝ Reports tab.

-

Select the filter “Unresolved disputed transactions regardless of date”.

- Click Refresh Report.

- Click the link next to the disputed charge.

-

Follow the instructions on the next screen. Enter as much evidence as possible before the date listed on this screen.

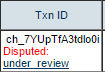

-

Once evidence is submitted, the link next to the charge will change to “under_review” while it is being reviewed. During this time, you may resubmit evidence up to 4 times before the indicated deadline. Allow 60-75 days for the review to be completed.

-

When the review is completed, the status will change to “won” or “lost”.

How long does the dispute process take?

Dispute resolution can take a long time, and we know that’s frustrating. During a dispute, banking entities engage in a series of formal communications that are a rigid part of the process, and we really can’t affect the timeline set in place by the banks and card networks. You can expect a dispute to be finalized approximately 60 days from the date the evidence was due (not the date you provided evidence). If it has been more than 60 days since the bank’s evidence deadline, feel free to reach out to us, and we’ll be happy to take a closer look!

What evidence do you suggest that I provide?

The evidence you’ll want to submit will vary depending on the specific case. Web logs, customer service emails, shipment tracking numbers, and delivery confirmation, proof of prior refunds or replacement shipments, and so on, can all be helpful. You’ll want to provide evidence appropriate to the type of dispute—we offer suggestions here. Stripe will submit any information you can provide to your customer’s credit card company, and keep you posted afterward.

Note that it is safe to assume that requests to call a contact number, click through to further information, and so on, will not be fulfilled by the institution that is evaluating the dispute. Banks will not follow external links to view your website or files you’ve uploaded elsewhere, so it’s important to include all evidence at your disposal in your initial evidence submission.

It is extremely important to provide evidence for every dispute you hope to win, even if the cardholder/customer has told you they will withdraw the dispute.

What happens when a charge is reported as a “Fraudulent Charge”?

The disputed amount and the fee are deducted from your account the day after a dispute is received. The disputed amount and fee are refunded to your bank account if the dispute is resolved in your favor. This is referred to as a chargeback.

What happens when a charge is reported as an "Unrecognized Charge"?

An “Unrecognized Charge” is an inquiry or retrieval request that asks for information about a transaction. These usually occur after a cardholder calls their issuing bank about a charge they don’t recognize or another discrepancy on their bill. The disputed amount is not deducted from your account, and no fee is charged.

-

If you choose to refund the full amount, the dispute will automatically be resolved. However, if the charge is valid and you do not wish to refund, it is always recommended that you reach out to your customer first to get more information about the reason for the dispute.

-

If you reach an agreement with your customer, and they agree to withdraw the dispute, it’s still important to provide evidence (even if it’s simple text evidence indicating that you’ve communicated with them and they’ve agreed to withdraw)